Revenue-Based Financing Explained: A Smart Business Funding Option for Freelancers

Wiki Article

Unlocking Service Financing: Techniques for Lasting Growth in Your Working as a consultant

Gaining access to service funding is a crucial variable for the lasting growth of a consultancy. Many consultants battle to identify their monetary demands and discover potential resources. Typical funding choices commonly feature rigorous requirements, while different financing can be elusive. A well-crafted company strategy functions as a foundation, yet it is only the start. Comprehending exactly how to develop partnerships with investors and take advantage of technology can make a considerable difference. What methods can specialists use to browse this complex landscape?Comprehending Your Funding Demands

Understanding funding needs is important for any organization seeking to expand or maintain its procedures. A complete assessment of these needs permits companies to determine the resources required for numerous campaigns, whether it be for expansion, item development, or operational effectiveness. This analysis needs to encompass both temporary and long-lasting financial objectives, making it possible for firms to prioritize their financing demands successfully.Additionally, organizations should analyze their existing monetary situation, including cash money flow, existing debts, and earnings projections. This analysis helps in determining the proper amount of funding needed and the possible influence on the company's general economic health and wellness. By plainly recognizing their financing requires, companies can develop a tactical strategy that straightens with their growth purposes. Ultimately, this quality cultivates informed decision-making, permitting the option of suitable funding approaches that can efficiently sustain their aspirations without jeopardizing economic stability.

Discovering Traditional Financing Choices

Traditional financing options play a vital duty in protecting funds for businesses. This includes recognizing the ins and outs of financial institution finances, the possible benefits of aids and gives, and the understandings supplied by financial backing. Each of these methods provides one-of-a-kind chances and obstacles that entrepreneurs must carefully consider.Bank Loans Explained

Several business owners consider financial institution financings as a key financing alternative because of their structured nature and well-known track record. These finances provide services with a round figure of funding that should be settled over an established duration, often with rate of interest. The application procedure commonly requires comprehensive economic paperwork, consisting of business plans and credit report, enabling banks to examine risk properly. Passion rates can vary based upon the customer's creditworthiness and the overall market problems. While small business loan allow access to significant funds, they likewise impose stringent repayment timetables, which can strain capital. Business owners should consider these advantages and drawbacks carefully to determine if a bank lending lines up with their long-term development strategies and financial abilities.Grants and Subsidies

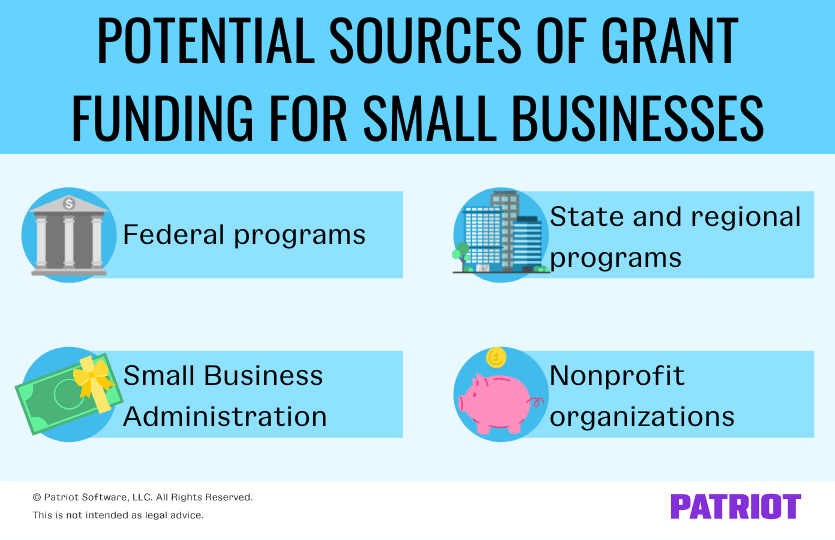

For services looking for option financing aids, alternatives and grants provide an engaging method. These monetary sources, commonly provided by government entities or not-for-profit companies, do not require settlement, making them an attractive choice for consultancies aiming for sustainable growth. Grants are normally awarded based on particular requirements, such as project propositions or area effect, while aids might sustain ongoing functional expenses, such as employee training or study and development. To access these funds, services must browse application processes that may consist of detailed proposals and monetary documentation. Recognizing qualification demands is crucial, as competition for these resources can be tough. Inevitably, leveraging aids and gives can considerably improve a consultancy's economic stability and capability for innovation.Financial Backing Insights

How can companies efficiently harness venture funding to sustain their development? Venture funding (VC) functions as an essential funding option for start-ups and broadening consultancies looking for substantial funding infusions. By engaging with VC firms, businesses get not just to funding but likewise to beneficial mentorship and sector connections. To bring in financial backing, firms need to provide compelling organization designs, demonstrate market possibility, and highlight solid management groups. Additionally, comprehending the assumptions of endeavor plutocrats concerning equity risks and roi is critical - Business Funding. Developing a clear leave technique can better improve charm. Inevitably, leveraging financial backing calls for a strategic positioning of goals, making sure that both celebrations share a vision for lasting development and long-lasting successLeveraging Option Financing Sources

In the domain name of business financing, alternative resources present one-of-a-kind opportunities for business owners. Crowdfunding platforms allow companies to engage straight with potential consumers, while angel capitalists give not just resources yet likewise useful networks and mentorship. By accepting these options, startups can improve their economic techniques and enhance their chances of success.Crowdfunding Opportunities Available

What innovative strategies can entrepreneurs discover to safeguard funds for their ventures? Crowdfunding has actually arised as a viable choice financing resource, allowing entrepreneurs to take advantage of a varied pool of potential investors. Platforms such as Kickstarter, Indiegogo, and GoFundMe enable organizations to offer their ideas straight to the public, producing interest and monetary assistance. This method not only supplies funding however also works as an advertising and marketing tool, verifying concepts via area engagement. Business owners can leverage rewards-based crowdfunding, offering services or products for her explanation contributions, or equity crowdfunding, where capitalists receive a stake in the venture. By efficiently connecting their vision and developing an engaging campaign, entrepreneurs can harness the Going Here power of crowdfunding to help with lasting development in their working as a consultants.Angel Investors and Networks

Angel investors represent a critical source of funding for business owners seeking to introduce or increase their ventures. These high-net-worth individuals supply not just financial backing but likewise very useful mentorship and sector links. By spending their personal funds, angel financiers commonly fill the void that standard financing approaches, such as small business loan, can not attend to because of stringent needs.

Business owners can boost their opportunities of bring in angel investment by signing up with networks that promote introductions in between start-ups and capitalists. These networks usually hold pitch occasions, giving a platform for entrepreneurs to showcase their ideas. Structure connections within these networks enables entrepreneurs to tap right into a riches of resources, recommendations, and potential collaboration, eventually driving lasting growth and advancement in their working as a consultants.

Crafting a Compelling Organization Strategy

While lots of entrepreneurs understand the relevance of a company strategy, few understand that an engaging file can substantially affect funding chances. A well-crafted business plan works as a roadmap, detailing the vision, goals, and methods of the consultancy. It needs to plainly detail the target market, affordable landscape, and one-of-a-kind value proposal, enabling potential capitalists to understand the working as a consultant's potential for growth.Financial forecasts, consisting of income forecasts and break-even analysis, are vital in showing business's viability. Business Funding. Additionally, a detailed threat evaluation highlights recognition of potential challenges and describes reduction methods, instilling self-confidence in capitalists

The executive recap, typically the very first area read, ought to be interesting and succinct, encapsulating the significance of the strategy. By concentrating on clearness, logical framework, and compelling stories, entrepreneurs can create a convincing company strategy that not just browse around this web-site brings in funding but additionally prepares for lasting development in their consultancy.

Building Strong Relationships With Investors

Networking is one more important facet. Business owners ought to attend market events, take part in on the internet forums, and utilize mutual connections to cultivate connections with possible investors. Customized communication can likewise make a considerable effect; customizing messages to mirror an investor's preferences and passions demonstrates genuine factor to consider.

Comprehending a capitalist's goals and aligning them with the consultancy's vision can develop a more engaging collaboration. By focusing on shared advantages and shared worths, entrepreneurs can reinforce these important partnerships, ensuring that capitalists continue to be involved and helpful throughout business's development journey. This foundation is essential for lasting success in the affordable consulting landscape.

Using Financial Innovation Tools

As organizations progressively seek cutting-edge methods to safeguard financing, utilizing financial innovation tools has arised as a necessary strategy. These tools offer streamlined processes for taking care of funds, making it possible for working as a consultants to make educated decisions rapidly. Platforms for crowdfunding, peer-to-peer borrowing, and electronic settlement options permit businesses to accessibility varied funding resources, decreasing reliance on conventional banks.Monetary technology devices boost openness and improve communication with possible investors. By using data analytics, working as a consultants can present engaging economic projections and development approaches, increasing their allure to funders. Automated budgeting and forecasting tools likewise make it possible for companies to handle sources properly, making sure that funds are alloted where they can generate the most effect.

In addition, financial modern technology solutions can help with better capital administration, permitting working as a consultants to preserve monetary health while seeking growth opportunities. By incorporating these devices into their financing methods, organizations can position themselves for lasting success in an increasingly affordable landscape.

Monitoring and Adjusting Your Funding Approach

To assure lasting success, organizations should continually keep track of and adapt their financing techniques in response to moving market problems and financial landscapes. This positive approach makes it possible for companies to recognize arising chances and possible dangers, guaranteeing their funding stays lined up with their strategic goals. Consistently evaluating monetary performance metrics, such as capital and earnings margins, allows services to make enlightened decisions regarding reapportioning resources or seeking new financing sources.In addition, staying informed concerning industry trends and competitor approaches is essential. This knowledge can assist adjustments to funding methods, whether with standard financings, venture capital, or alternate funding techniques. Engaging with economic experts and leveraging economic technology can enhance understandings right into financing alternatives.

Eventually, a vibrant financing method not just sustains instant demands but likewise settings services for sustainable growth, fostering resilience in an ever-changing industry. Flexibility in funding methods is important for maneuvering the intricacies of contemporary company environments.

Frequently Asked Questions

What Common Mistakes Should I Prevent When Looking For Funding?

Usual errors when seeking financing consist of poor study on possible financiers, failing to express a clear value suggestion, undervaluing financial projections, neglecting to plan for due persistance, and not complying with up after first conferences.Just How Can I Determine My Consultancy's Financing Timeline?

To identify a consultancy's financing timeline, one need to assess job requirements, assess cash flow cycles, develop landmarks, and take into consideration outside financing sources. This organized approach helps line up financial goals with functional needs properly.What Role Does Credit History Play in Funding?

Credit report plays a necessary role in funding by affecting lenders' decisions. A greater rating commonly boosts qualification and terms, while a lower score may limit access to favorable funding options, affecting general funding opportunities substantially.Exactly How Do Financial Fads Influence Financing Accessibility?

Economic trends greatly influence financing accessibility by impacting financier confidence, passion prices, and borrowing practices. Throughout economic recessions, moneying ends up being scarcer, while periods of development often result in increased financial investment possibilities and more easily accessible funding alternatives.Can I Secure Financing Without a Proven Performance History?

Safeguarding financing without a tested track record is challenging but feasible. Cutting-edge concepts, solid service strategies, and efficient networking can bring in financiers happy to take risks on unproven endeavors, particularly in emerging markets or industries.

Report this wiki page